Mission

Catch The Star.

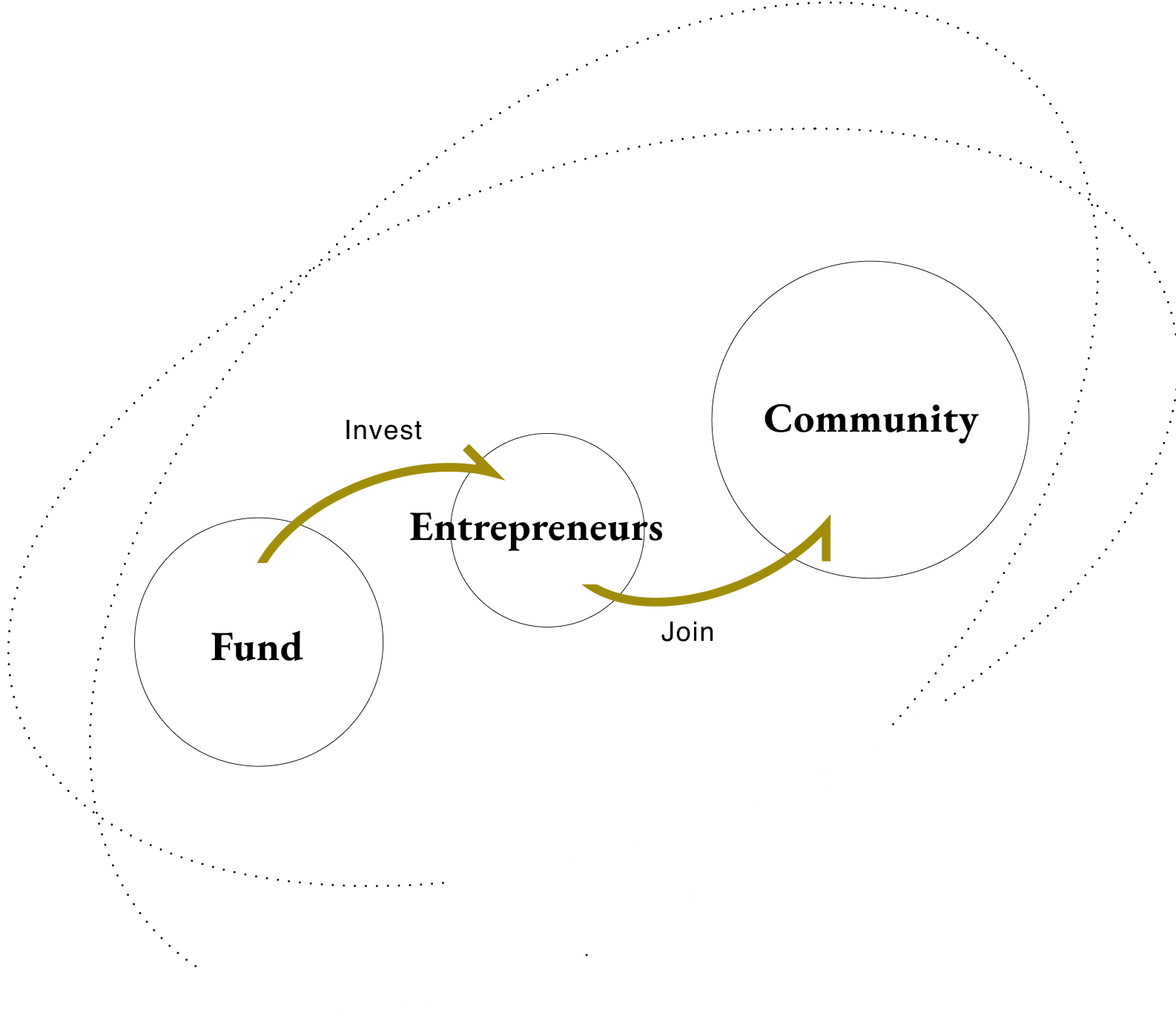

Chiba Dojo is an entrepreneurial community with the capabilities of a venture capital firm. Around 100 visionary entrepreneurs actively collaborate and push each other to achieve ambitious goals — true to our mission, “Catch The Star.” This exclusive community is open only to entrepreneurs backed by the Chiba Dojo Fund. Established in 2019 to foster and grow this vibrant entrepreneur community, the Chiba Dojo Fund has raised around JPY 6 billion in each fund with support from a diverse range of LPs. We actively invest in a broad spectrum of startups and are committed to supporting visionary founders who will shape the future.

Catch The Star.

Creating a brighter, happier future

through technology that solves

the world’s greatest challenges.

General Partner, Chiba Dojo Fund

General Partner, Chiba Dojo Fund

General Partner, Chiba Dojo Fund

Fund Controller, Chiba Dojo Fund

Associate, Chiba Dojo Fund

fellow, Chiba Dojo Fund

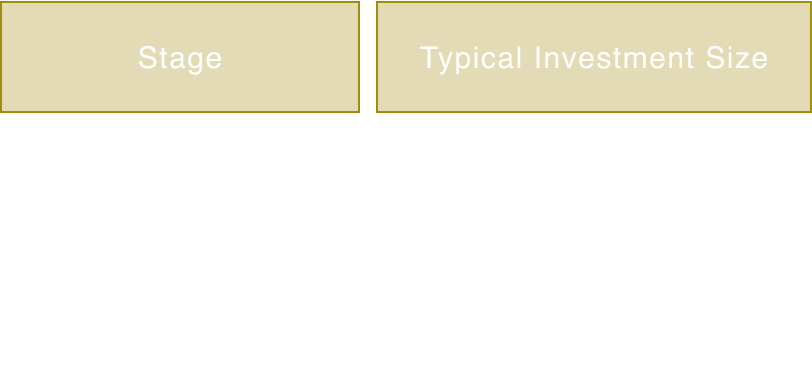

Chiba Dojo Fund primarily invests in startups at the Seed, Early (Pre-Series A), and Later stages. We actively support our portfolio founders from the moment they join the Chiba Dojov community through to a successful exit (including IPO). We also provide follow-on funding beyond the initial investment, often making significant later-stage investments to accelerate growth and maximize impact.

We invest across a wide range of industries and business models without setting rigid boundaries. Our scope extends beyond Japan, with active consideration for opportunities in North America, Southeast Asia, and other international markets. The only exception is the drone sector, which lies outside our investment scope. For drone-related ventures, please contact Drone Fund.

For Seed to Early-stage (Pre-Series A) rounds, our typical initial investment ranges from a few million yen to roughly JPY 300 million. For later-stage rounds, we generally invest from tens of millions up to JPY 600 million . ※This is the maximum amount we may invest in a single round

In Seed to Early-stage rounds, we usually serve as the lead investor (though we can also co-invest alongside other lead investors). In later-stage financings, we typically participate as a follow-on (non-lead) investor.

We are a venture capital fund built on the foundation of an entrepreneurial community. Beyond conventional investment decisions, we invest with the aim of welcoming founders into our community.

Our standard investment process takes about

one month from the initial meeting to a final investment decision.